The Strategy Roller is a feature of the thinkorswim platform that can be used to help manage Covered Call option strategies. This tool offers a new way of managing Covered Call positions with greater ease and equal flexibility. By setting up a Rolling Strategy for a Covered Call position, the tool can help you manage rolling Covered Call positions from one expiration to another according to simple rules that you specify ahead of time and with fewer steps.

Here is how you can roll your options in Strategy Roller:

1. Navigate to Monitor tab > Strategy Roller. Under Eligible Positions, select the covered call you wish to roll.

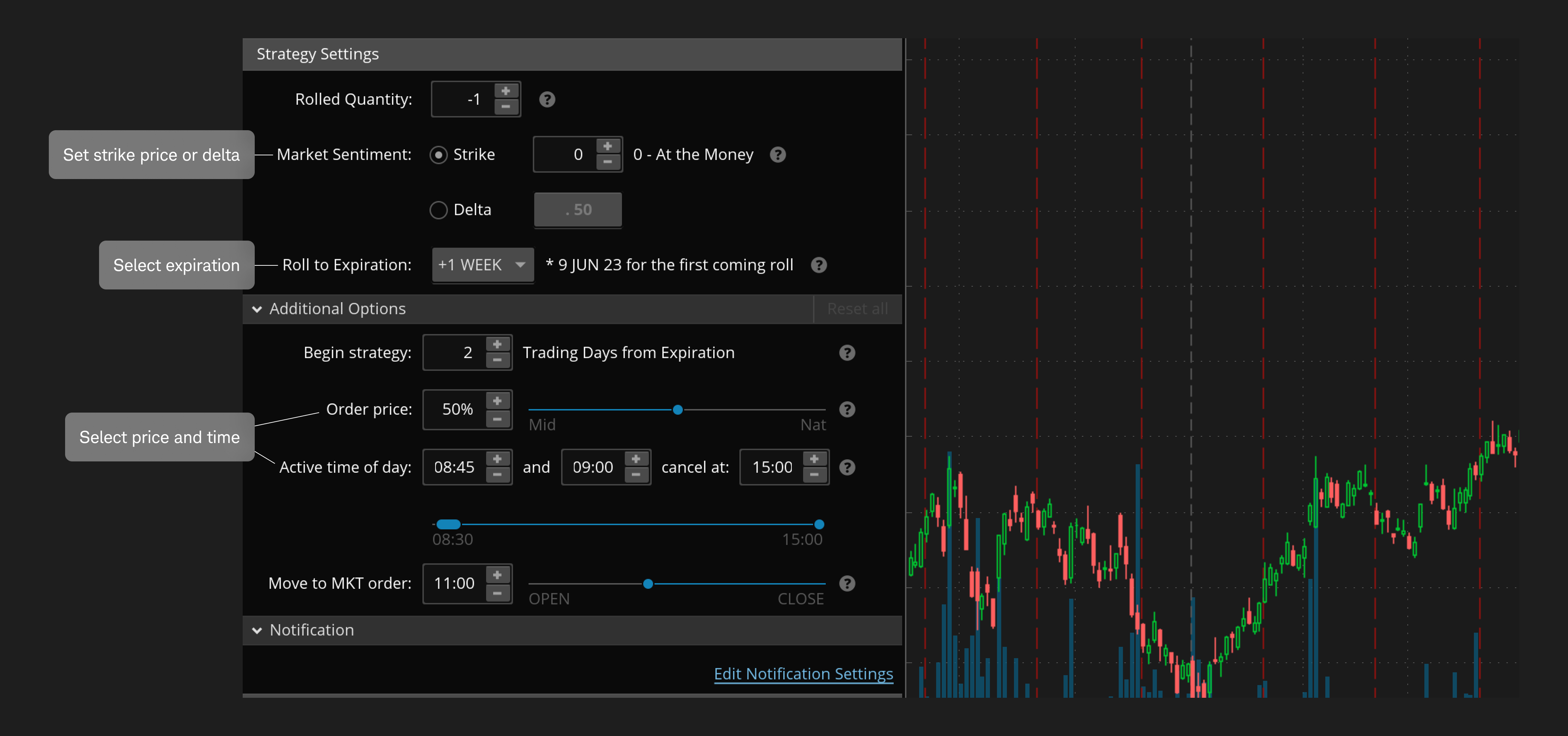

2. Set the strike price to which you will be rolling this position – using the strike offset or the options delta.

- If you choose to set it based on the strike, specify how many strikes away from the money you wish the option to be. Select 0 to automatically use the at-the-money option, a positive value to use an out-of-the-money option, or a negative value to use an in-the money option. For example, setting the Strikes value to 2 will roll your option to two strikes out of the money. Setting Strikes to -1 will roll your position to one strike in the money.

- If you use delta, the new option will be selected based on the following: delta equal to 50 sets an at-the-money option, delta below 50 sets an out-of-the-money option, and delta higher than 50, an in-the-money option.

3. Select your target expiration using the Roll to expiration dropdown. The selected expiration will appear next to the dropdown.

4. Specify how many days prior to expiration you wish to start to roll your position and adjust the limit order price. By default, it is the midpoint price.

5. Adjust additional parameters such as the time of day you wish your rolling order to be entered or cancelled, if necessary.

6. Carefully review your rolling order summary in the bottom pane of the Strategy Roller window.

7. Click Confirm and activate. This will open a confirmation dialog. Click Activate. Your rolling strategy will be submitted.

Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. You are responsible for all orders entered in your self-directed account.

Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.