Featured

Several highlights we've selected for you.

Order Entry and Saved Orders

The main order entry tool appears at the bottom of your screen and can help you create several common orders (check out Order Types for a complete list) and save custom orders you create. You can open this tool by clicking BUY or SELL for a symbol.

Once opened, click the dropdown in the Order column to select an order type. The entry tool will then change to the order template for that type.

Notice how the order price, except for ~MKT market orders, automatically changes based on underlying mark price. This is an unlocked price value and can be “locked” by clicking the % lock icon next to the price.

- An open lock %is an unlocked price that changes as the underlying changes.

- A closed lock & is a locked price that doesn’t automatically change.

Locked prices don’t change automatically but can be adjusted using the + and – buttons. Regardless of order type you can always type in or use the + and – buttons to adjust order price.

This page covers the following content:

- Market Orders

- Limit Orders

- Stop Orders

- Stop Limit Orders

- Trailing Stop and Trailing Stop Limit Orders

- Market on Close (MOC) Orders

- Limit on Close (LOC) Orders

- Order Rules

- Saved Orders

If you are interested in learning about Walk Limit® orders, please refer to this page.

Quotes

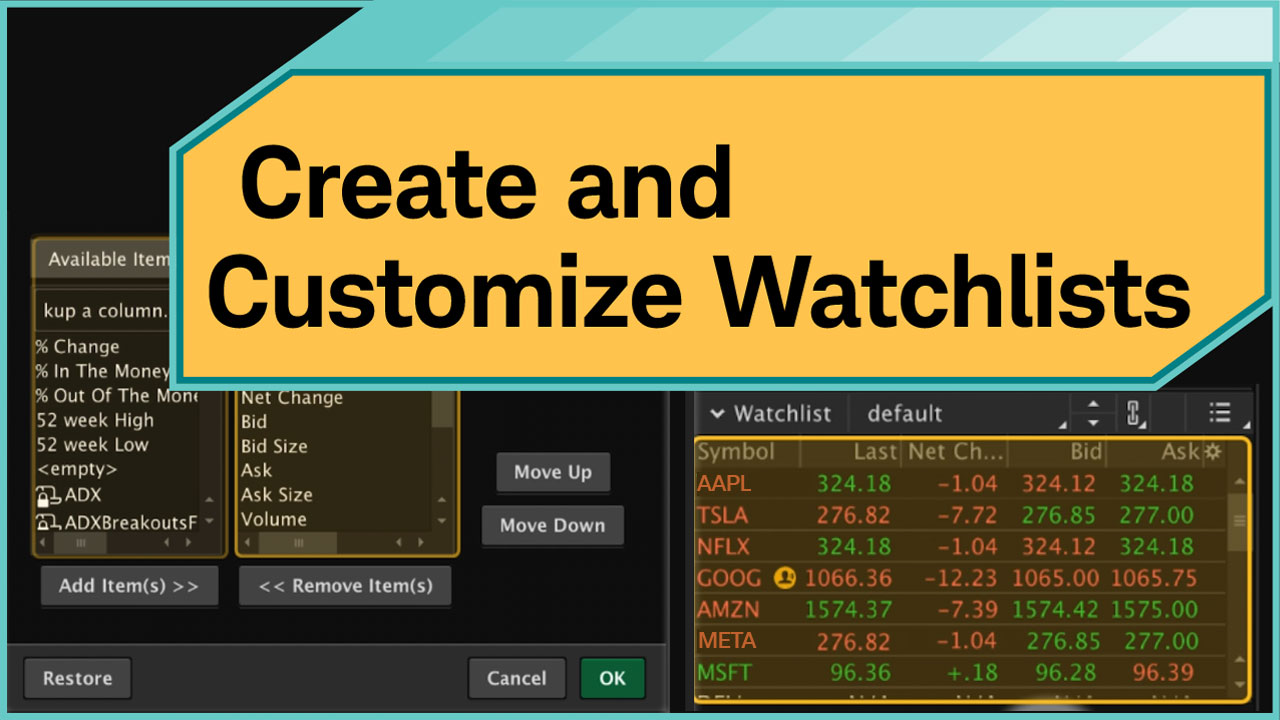

The Quotes interface allows you to create and edit watchlists. To access it, click the MarketWatch tab and select the Quotes subtab. A watchlist is a collection of symbols grouped together with market data. Watchlists can include companies, derivatives, or indices such as NASDAQ 100, the Dow Jones Industrials, or the S&P 500. Watchlists may also contain symbols that represent economic trends or industry groups, these symbols are not directly tradeable but are comprised of instruments that are.

In the header, you can find the following controls:

- Watchlist selector. Click the watchlist name to create, delete, or switch between watchlists. In addition to your personal watchlists, you can access public watchlists from categories such as Lovers and losers, Top 10, and industry-based lists. You can also view your portfolio watchlist, which displays symbols that have positions in the currently selected account.

- Arrows. Use the up and down arrows to move through watchlists in a group. The up arrow takes you to the previous watchlist, while the down arrow takes you to the next.

- Symbol link. Use the color-coded clipboard to link components. Clicking the icon opens a color-and-number selection menu. In this menu, select a color to link the watchlist to other thinkorswim components with the same color code.

Tip: Consider linking a watchlist to the symbol selector and the Dashboard gadget. This way, clicking through the watchlist automatically displays the corresponding symbols in the symbol selector and the Dashboard. - Show actions menu. Create, edit, and delete watchlists. In addition, this menu enables you to create dynamic watchlists based on your criteria; these watchlists consist of scan results (for more details, see Scan).

You can also add or edit securities in a watchlist directly:

- To add a security: Click the empty cell at the bottom of the Symbol column, type a symbol, and press Enter.

- To edit a security: Click the security’s name in the Symbol column, type a new symbol, and press Enter.

After configuring your watchlists, you can customize them in the following ways:

- Reorder columns. Click and drag a column header to the desired position.

- Sort by column. Click a column header to sort the watchlist. An up arrow appears for ascending order, clicking again switches to descending order (indicated by a down arrow). To remove sorting, click the header a third time or right-click and select No sorting.

- Change column set. To add or remove columns, right-click a column header and choose Customize... In the dialog window, you will see two areas: All columns (left pane) and the current set (right pane).

- To add a column, select it in the All columns and click Add.

- To remove a column, select it in the current set and click Remove.

- You can also drag and drop columns between panes or double-click to add or remove them.

- Click OK to save your changes.

You can also create custom watchlist columns using thinkScript. To learn more, see Custom Quotes.

Workspaces

In thinkorswim® you’ve always gotten to build your own sandbox. As you use the platform, you’ll likely change some of the settings or select different features to use. As you change things to better suit your trading needs, you’re also building your own sandbox.

But what if you don’t know where to start?

At thinkorswim®, we’ve created six different setup windows you can choose from. These different setups are what we call workspaces. If you ever want to change your workspace, use the Setup Wizard available from the Setup menu.

You can still build your own sandbox, but now you have a place to start!

Holiday

Holiday

Holiday

Holiday