The Pairs Trader tab is a thinkorswim® interface that allows you to trade two symbols as a single pair. This can be useful for strategies that involve buying one symbol while selling another or monitoring the relationship between two instruments over time. This interface can be accessed by clicking Pairs Trader on the Trade tab.

Selecting Pairs

When you open the Pairs Trader tab, you will see two main symbol selectors: Left Side and Right Side. Use these to choose the two instruments you want to compare and trade. Each side includes:

- Symbol field to type or select the desired instrument.

- POS indicator that shows your current position status for the selected instrument: gray indicates you hold no position, green indicates you hold a long (buy) position, red indicates you hold a short (sell) position. Clicking the POS field opens a shortcut to view related trades.

- Lot multiplier to set the trade size ratio between the two instruments. Qty sets the base lot size, and the multiplier sets how many lots you’ll trade on each side. Adjusting this value lets you scale one side relative to the other.

- Trigger value to set the price ratio at which you intend to trade. Entering a trigger value lets you monitor when the ratio reaches the chosen threshold.

- Quantity selector sets the base number of shares or contracts for each side of the pair. This is not the total trade size on its own, it defines the lot size that will by multiplied by the value you set in the multiplier field.

Pairs Chart and Correlation

Below the symbol selectors, each side displays a price chart for the corresponding composite symbols (left side minus right side). You can customize these charts using the Style, Drawings, and Studies menus, just as you would in the Charts interface.

At the bottom of each chart, you will see the Pair Correlation study. This displays a real-time statistical correlation between the two instruments over a selected time period. A correlation close to 1 indicates the two instruments have tended to move together, while a correlation near -1 indicates they have tended to move in opposite directions.

Placing Pair Trades

The Buy Pair and Sell Pair buttons allow you to place simultaneous orders for both instruments in your chosen configuration. For example:

- Buy Pair will buy the left-side instrument and sell the right-side instrument in the corresponding trade sizes you have set.

- Sell Pair will sell the left-side instrument and buy the right-side instrument in the corresponding trade sizes you have set.

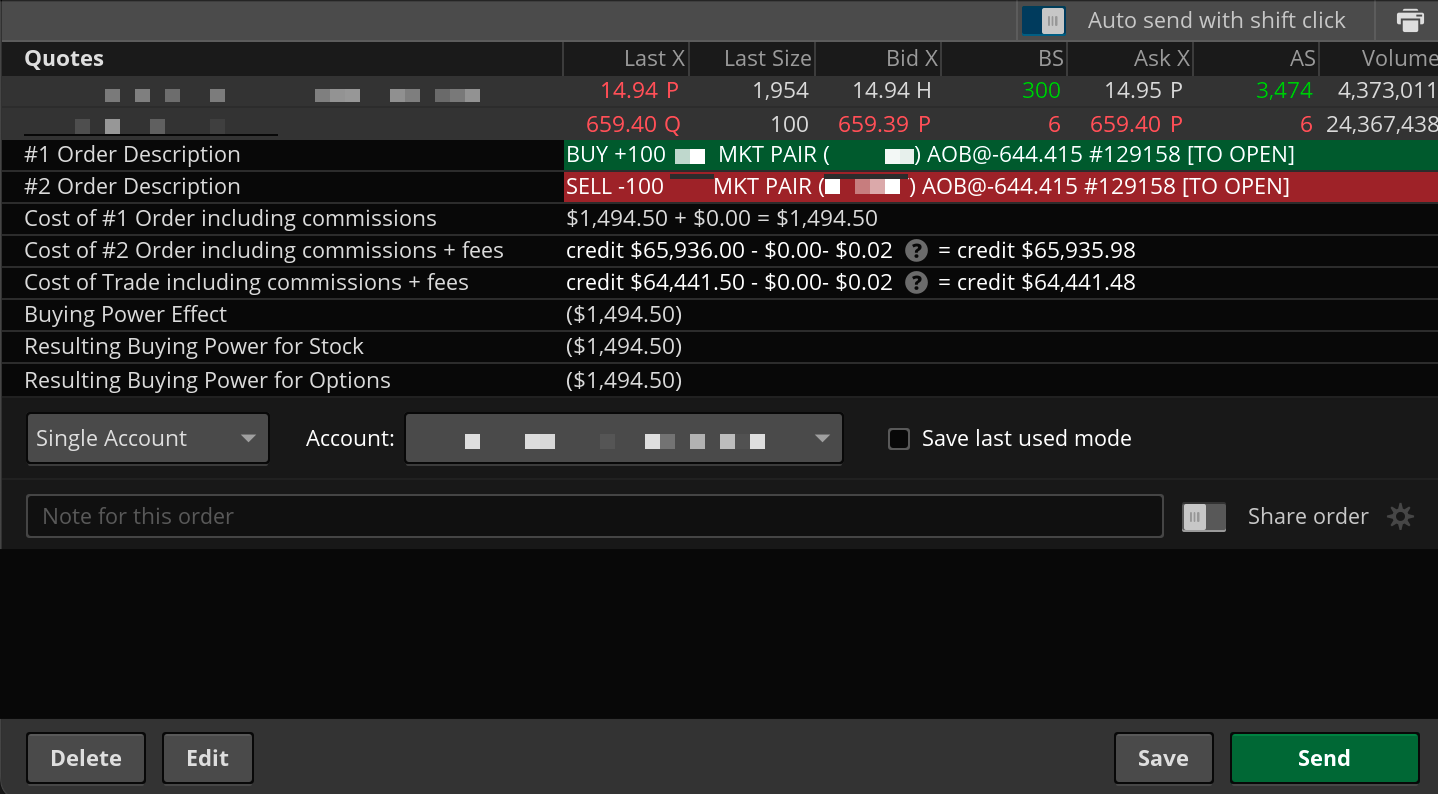

After clicking either button, the Order Entry panel with both orders will appear at the bottom of the platform. Review the details carefully, make adjustments if needed, and click Send to place the order.

Pair Orders carry special execution risks as each leg executes separately as a market order once your trigger price is met.

With stop orders, there is no guarantee that the execution price will be equal to or near the activation price.

Customizing the Layout

You can adjust the chart time frames, add or remove studies, and change chart styles independently for each side of the Pairs Trader. Use the chart toolbar icons to:

- Select a new timeframe or aggregation period.

- Add technical studies, predefined or custom.

- Apply drawings and annotations.

To monitor a different pair, simply change one or both symbols in the Left side and Right side fields.