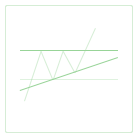

The Ascending Triangle is defined by two lines: a horizontal resistance line running through peaks and an uptrend line drawn through the bottoms. While two bottoms belonging to the same trendline would suffice for pattern recognition, it is more favorable when there are more. This describes perfect conditions for the Ascending Triangle formation, which means that overall signal strength is set to maximum. However, it's a rare occasion to find a perfect triangle, so in the majority of cases both trendline and resistance line will be pierced by false intrabar breakouts; the resistance line can be also slightly inclined. It is suggested to watch out for false breakouts carefully as they might be easily confused with the true ones when, in fact, the price is going to retreat back into the triangle.

Generally speaking, the Ascending Triangle is a bullish continuation pattern. However, exceptions are quite possible: it's not infrequent to see it develop in downtrend conditions. If formed in the downtrend, the Ascending Triangle is more likely to act as a reversal pattern. Breakouts can also happen in both directions. Statistically, upward breakouts are more likely to occur, but downward ones seem to be more reliable. Majority of breakouts of either direction are observed in the second half of the pattern formation distance. In the geometrical sense, this distance is measured between two points: the first high to low reversal and the point at which the trendline and the resistance line cross (so-called apex).

Volume behavior throughout the pattern formation can be quite erratic and thus risky to rely on.

For educational purposes only. Not a recommendation of a specific security or investment strategy.

Technical analysis is not recommended as a sole means of investment research.

Past performance of a security or strategy does not guarantee future results or success.