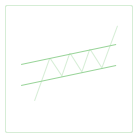

The Channel Up pattern is identified when there are two parallel lines, both moving up to the right across respective peaks (upper line) and bottoms (lower line). The lower line is identified first, as running along the lows: it defines the trendline. The upper line (or, the channel line) is identified as parallel to the trendline, running across the first prominent peak. When in the channel, prices are expected to bounce off both upper and lower boundaries; the more such reversals occur, the more reliable the pattern.

Breakouts from the Channel Up can occur in both upward and downward directions, having exactly the opposite meanings. When the price breaks through the trendline, it might indicate an important, sometimes a severe change in trend. Breaking through the channel line, on the contrary, suggests acceleration of the existing trend. Note, however, that just like all the other patterns, channels might be prone to false or premature breakouts, which means that price sometimes retreats back into the channel.

Another strategy of using the Channel Up is to identify where the price fails to reach the upper line. As opposed to breaking through this line, the failure to reach it often signifies trend exhaustion. This could be an early warning that the trend is going to reverse: the breach of the trendline is now more likely to happen.

For educational purposes only. Not a recommendation of a specific security or investment strategy.

Technical analysis is not recommended as a sole means of investment research.

Past performance of a security or strategy does not guarantee future results or success.