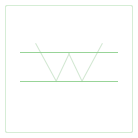

The Double Bottom is the inverse of the Double Top. Being one of the simplest formations, it consists of three reversal points: two bottoms of nearly the same size and a peak between them, hence the name of the pattern. The line running through the bottoms is the resistance line which should be nearly horizontal.

Being a clearly reversal pattern, Double Bottoms appear in the downtrend and reverse it to the upside as price breaks through the resistance line (the one running through the peak, parallel to support). Premature breakouts can be a problem in Double Bottoms as they occur frequently, depending on the bottom shape. Performance-wise, among the Double Bottoms, the ones with rounded valleys seem to be the most desirable to find. On the bright side, Double Bottoms might signify a strong uptrend even after the flat base, i.e., there was no trend at all before the pattern emergence.

Double Bottoms develop rather quickly: it takes only several weeks for them to be completed. Volume usually trends downward and this is considered more favorable than uptrending or erratic volume.

For educational purposes only. Not a recommendation of a specific security or investment strategy.

Technical analysis is not recommended as a sole means of investment research.

Past performance of a security or strategy does not guarantee future results or success.