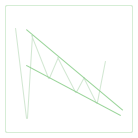

The Falling Wedge pattern is the opposite of the Rising Wedge: it is defined by two trendlines drawn through peaks and bottoms, both headed downward. It takes at least five reversals (two for one trendline and three for the other) to form a good Falling Wedge pattern.

Both Rising and Falling wedges show great versatility: they could appear as consolidation patterns with the trend, or against the trend, or even as topping patterns after a climax. Statistically, the latter are less often to occur but seem more striking than consolidation. When following an uptrend, the Falling Wedge pattern shows gradual decline in price which, in most cases, will end up breaking through the upper line, thus continuing the preceding trend. Downward breakouts are much less expected: one study shows that virtually all breakouts happen to the upside and another study states that at least two thirds do. Thus, the Falling Wedge is generally regarded as a bullish pattern.

Falling Wedges often come after a climax trough (sometimes called a "panic"), a sudden reversal of an uptrend, often on heavy volume. In this case, price within the Falling Wedge is usually not expected to fall below the panic value, ending up in breaking through the upper trendline. During the pattern formation, volume is most likely to fall; however, better performance is expected in wedges with high volume at the breakout point. Gaps before the breakout are also said to improve the performance.

The estimated performance of the Falling Wedge is a bit higher than that of the rising one, but still questionable. Nonetheless, the results for the non-classical combination of Falling Wedge in downtrend with a downward breakout seems to work surprisingly better than all other wedge combinations; as one can expect, they are rare to find. The wedge width can also be a performance factor: wider wedges seem to be more reliable than the narrow ones.

For educational purposes only. Not a recommendation of a specific security or investment strategy.

Technical analysis is not recommended as a sole means of investment research.

Past performance of a security or strategy does not guarantee future results or success.