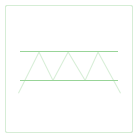

In the Triple Top formation, the price is bounded between two horizontal lines. Three peaks need to belong to the upper line, hence the pattern name. This describes perfect conditions; in reality it's only required for peaks to be about the same height. In fact, when the last peak fails to reach the middle peak's value, the trend might be getting exhausted, thus a stronger decline can be expected.

Triple Top is commonly regarded as a bearish reversal pattern. Stronger reversals tend to happen to stronger trends: the decline will be the greater, the greater was the rise that led to the pattern. Preceding trend intensity is also important: a Triple Top emerging after an intensive uptrend might be expected to result in a steep decline.

Volume trends down throughout the formation more often than not, but rising volume observed every now and then seems to be more favorable. In addition, pullbacks happen quite often, which deteriorates pattern performance.

For educational purposes only. Not a recommendation of a specific security or investment strategy.

Technical analysis is not recommended as a sole means of investment research.

Past performance of a security or strategy does not guarantee future results or success.