Description

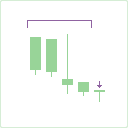

The ConsBarsDownSE strategy generates a short entry signal when a decreasing price sequence is found. By default, a sell to open simulated order is added after a sequence of four bars, each closing below the previous one. The length of the sequence and the price type can be customized in the input parameters.

To mirror the conditions for the long entry signals, use ConsBarsUpLE.

Note: Using the strategy on a Renko Bars chart may generate more signals.

Input Parameters

| Parameter | Description |

|---|---|

consecutive bars down

|

The number of bars in the sequence to generate the signal. |

price

|

The price analyzed for decreasing sequences. |

Further reading

1. "Using Renko Charts" by John Devcic. Technical Analysis of Stocks & Commodities, December 2019.

Backtesting is the evaluation of a particular trading strategy using historical data. Results presented are hypothetical, and there is no guarantee that the same strategy implemented today would produce similar results.

Technical analysis is not recommended as a sole means of investment research.

For educational purposes only. Not a recommendation of a specific security or investment strategy.