Description

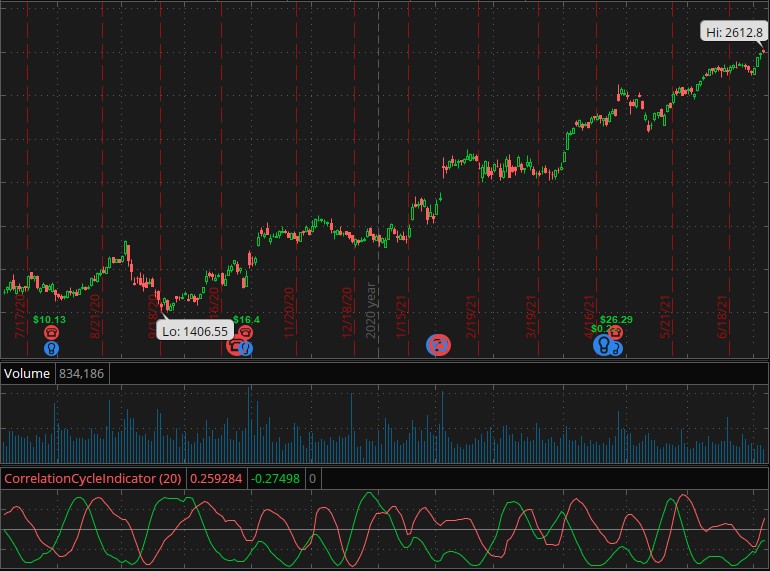

The Correlation Cycle Indicator analyzes the correlation of the price with a cosine wave over a presumed wavelength of the cycle. This indicator is best used when the market is in the cycle mode. The plot of the correlation of the price with a cosine wave may help identify turning points as it forms peaks and valleys coinciding with peaks and valleys in the price.

In addition to the cosine-based correlation plot, the study shows the negative-sine wave correlation. This correlation can be considered rate of change since the negative sine wave is the derivative of the cosine wave. Crossovers of this plot with the zero level may help detect the beginning and the end points of cycles.

Note: Since this indicator is designed to be used in the cycle mode, consider pairing it with the Correlation Cycle Angle study, which can help detect trending and cycle modes.

Input Parameters

| Parameter | Description |

|---|---|

length

|

The presumed wavelength. |

Plots

| Plot | Description |

|---|---|

CorrelationWithCosine

|

The correlation of price with a cosine wave. |

CorrelationWithNegativeSine

|

The correlation of price with a negative sine wave. |

ZeroLine

|

The zero level. |

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.