Description

Ermanometry is a technical indicator which indicates trend turning points based on the premise that price changes in a fixed-ratio manner. The fixed-ratio is established by calculating the number of bars in the first two trend segments on chart: uptrend and downtrend (or vice versa). You can specify the desired trend segments by starting date and time of the first segment and the number of bars in each.

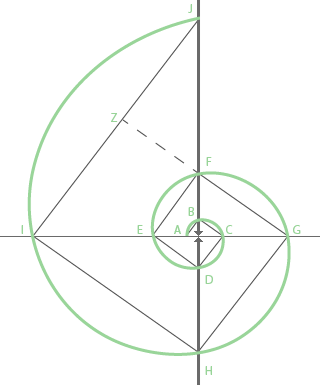

Once the lengths are specified, the study calculates time points of the expected trend reversals. This can be done by using a linear rectangular spiral, where the found lengths are the seed segments (DE and EF).

As was proposed by William Erman, the following segments are calculated: FH, GH, HI, IJ, DE+EF+CD, GH+HI+IJ, CD+DE+EF+FG+GH+HI, EF+FG+GH, CD+DE+EF+FG+GH, GH+IJ+CD+AB+EF.

Andrew Coles expanded this list by adding the following segments: FH+FG+GH, AB+BC+CD+DE, AB+BC+CD+DE+GH, FG+GH, GH+HI, FG+BC+CD, FG+BC+CD+DE, CD+BC, DE+BC, CD+DE+EC, EF+FG+EG.

Once calculated, these segments consequently mark the expected turnover points.

Input Parameters

| Parameter | Description |

|---|---|

start date

|

The start date of the first trend segment, specified with the built-in date picker or in the YYYYMMDD format. |

start time

|

The start time of the first trend segment, specified in HHMM format, EST timezone. |

length1

|

The length of the first trend segment, in bars. |

length2

|

The length of the second trend segment, in bars. |

launch point

|

Defines where to start time point calculations. |

vertical lines

|

Defines whether or not to supplement signals with vertical lines. |

Plots

| Plot | Description |

|---|---|

Erman

|

Time points proposed by W. Erman. |

Coles

|

Additional time points proposed by A. Coles. |

Launch

|

The start of the time point count. |

Segments

|

Two seed segments upon which the fixed ratio is defined. |

Further Reading

1. "TD Sequential and Ermanometry for Intraday Traders" by Andrew Coles, PhD. Technical Analysis of Stocks & Commodities, September 2011.

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.