Description

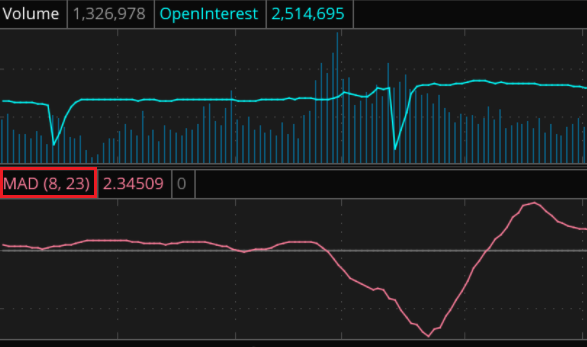

The MAD (Moving Average Difference) study is a trend-following oscillator based on the difference between two simple moving averages of price: a faster and a slower one. The lengths of the moving averages need to be selected so that the length of the slower average is greater than that of the faster one by half-length of the dominant market cycle. The difference between the averages is calculated as percentage of the slower one.

Input Parameters

| Parameter | Description |

|---|---|

fast length

|

The length of the faster moving average. |

slow length

|

The length of the slower moving average. |

Plots

| Plot | Description |

|---|---|

MAD

|

The Moving Average Difference oscillator plot. |

ZeroLine

|

The zero level. |

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.