Description

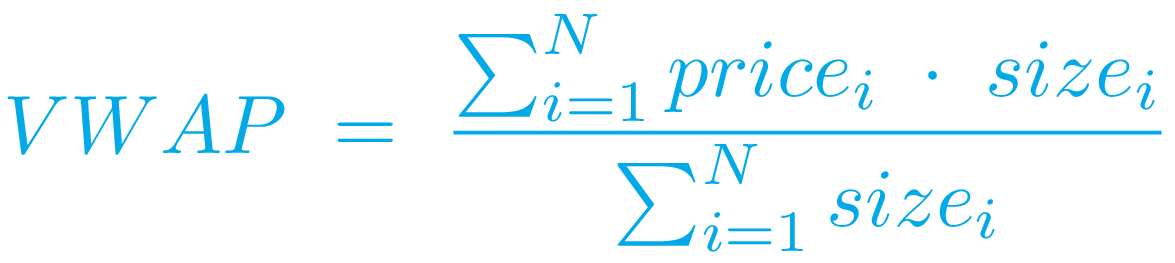

The Volume-Weighted Average Price (VWAP) is calculated using the following formula:

where sizei is the volume traded at pricei.

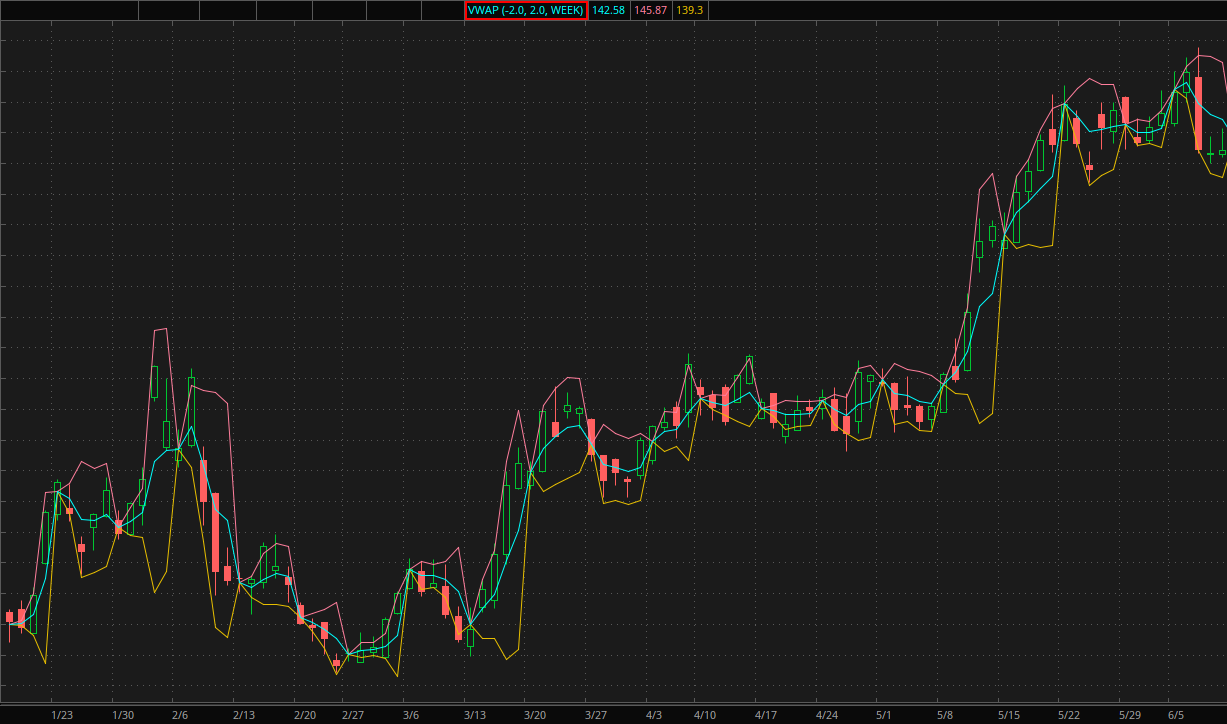

The VWAP plot is accompanied with two bands serving as overbought and oversold levels. The Upper band (overbought level) is plotted a specified number of standard deviations above the VWAP, and the Lower band (oversold level) is plotted similarly below the VWAP. Standard deviations are based upon the difference between the price and VWAP.

Input Parameters

| Parameter | Description |

|---|---|

num dev dn

|

The number of deviations defining the distance between VWAP and the Lower band. |

num dev up

|

The number of deviations defining the distance between VWAP the Upper band. |

time frame

|

The period on which cumulative calculations of VWAP and deviations are performed. |

Plots

| Plot | Description |

|---|---|

VWAP

|

The VWAP plot. |

UpperBand

|

The Upper band plot. |

LowerBand

|

The Lower band plot. |

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.