Description

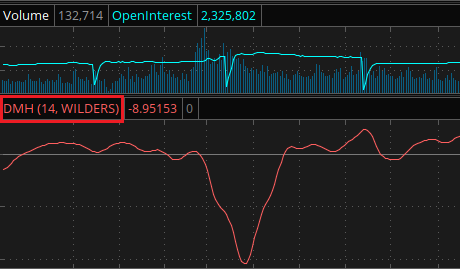

The Directional Movement using Hann (DMH) is an attempt at modernizing the original Directional Movement Index (DMI) developed by J. Welles Wilder in 1978. Much like the original study, DMH detects uptrend when the sum of consecutive differences between adjacent high prices is greater than the same between adjacent lows. The opposite is considered a downtrend signal. The difference between the two studies is that:

- The original DMI uses average true range (ATR) as a scaling factor for both sums in the calculation of the resulting ratio.

- DMH uses the Hann windowing function as a scaling mechanism and foregoes both ATR and ratio calculation.

Using Hann windowing instead of ATR scaling helps find reduce the lag introduced by the moving average component in the latter. Hann windowing gives most of the weight to the values around the middle of the function’s period and least of the weight to the values at the beginning and the end of it.

Input Parameters

| Parameter | Description |

|---|---|

length

|

The number of bars used in the calculation of DMH. |

average type

|

Defines the type of average to be used in calculations: Simple, Exponential, Weighted, Wilder’s, or Hull. |

Plots

| Plot | Description |

|---|---|

DMH

|

The DMH plot. |

ZeroLine

|

The zero level. |

Example*

*For illustrative purposes only. Not a recommendation of a specific security or investment strategy.

Past performance is no guarantee of future performance.